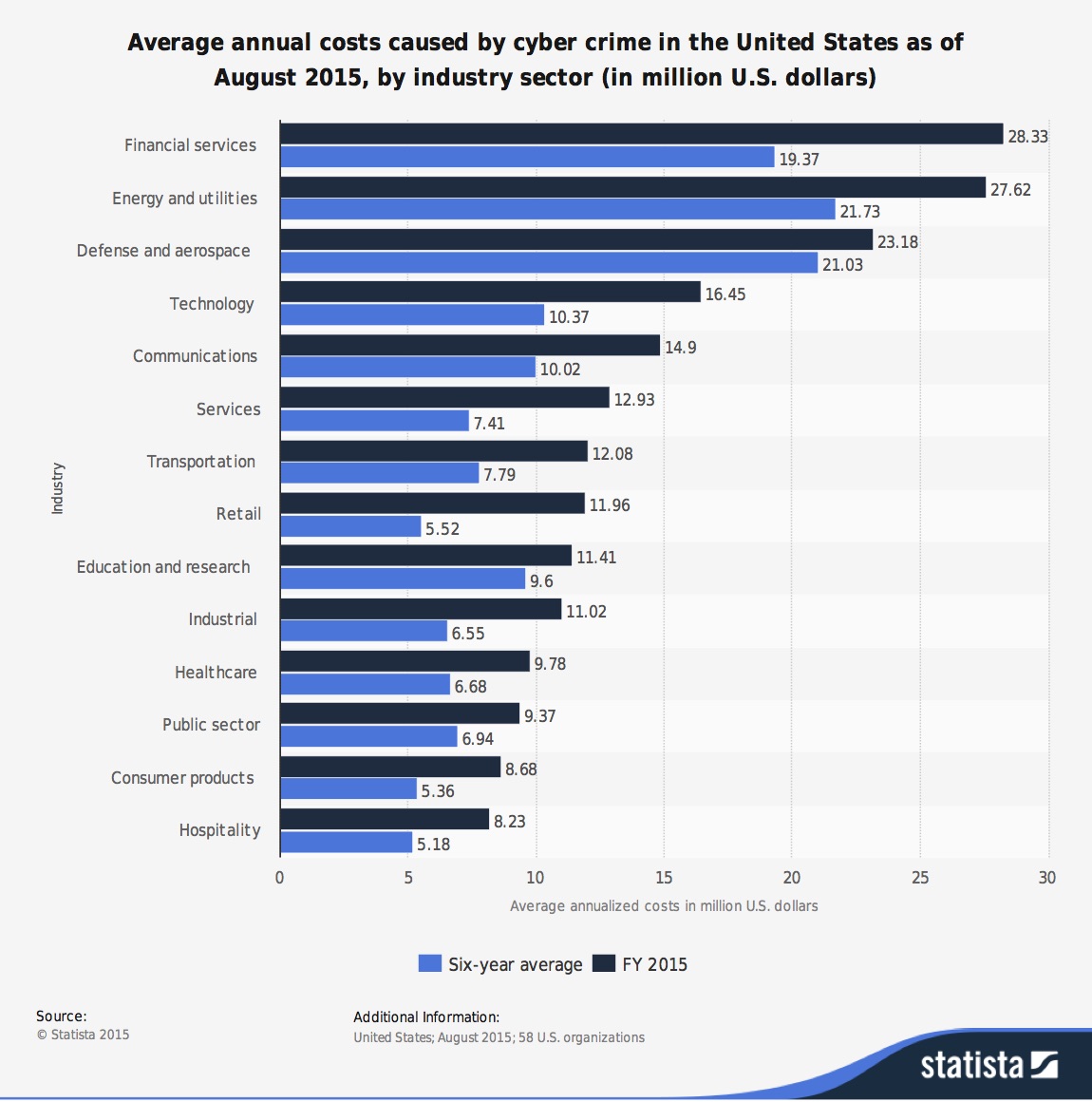

FFIEC Cybersecurity Statement: Shielding Banks from Theft

One of the largest financial cybercrime events in history happened in early 2016. Hackers successfully breached Bangladesh Bank’s systems and attempted to steal nearly $1 billion from its account at the Federal Reserve Bank of New York. By the time it was uncovered, the heist had netted hackers more than $80 million.

Continue reading >