HORNE

HORNE's Leadership Summit is an annual learning and development program for team members of the firm.

Employers increasingly are holding providers accountable for outcomes, and providers that can’t adapt will have a hard time competing.

As they continue to seek solutions to rising healthcare cost, employers are working with providers and health systems to optimize the value of their healthcare spend through options such as onsite care clinics, wellness programs, and value-based payment models for healthcare.

Continue reading >

Topics:

Payment Models,

APMs

After fits and starts over the last nine months, a broad tax reform plan is now beginning to emerge between Congress and the White House.

On Wednesday, an agreed upon framework was unveiled. While this is a mere starting point, some of the major guideposts are now known. The next step will be committee work and hearings before the House Ways and Means panel commencing in October.

Continue reading >

Topics:

Healthcare Reform Trump

In earlier blogs on MACRA, we’ve discussed a series of topics, including the flexibility in the first reporting year 2017 and the “Pick Your Pace” option in MIPS.

Continue reading >

Topics:

MACRA Summary

The old adage, "Money can make you do crazy things," can easily be applied to both our personal and business lives. Within the healthcare industry, HITECH incentive payments were offered by the U.S. government several years ago to implement electronic health record (EHR) systems at hospitals and other healthcare organizations. In order to qualify for these incentive payments, healthcare organizations were required to carry out regular security risk assessments to show they were meeting the HIPAA Security Rule requirements. While a large number of healthcare organizations properly followed the rules and carried out the security risk assessment required, a select number received the incentives without doing so.

Continue reading >

Topics:

Electronic Health Records

If your hospital or clinic uses a Windows 7-based version of a Siemens PET/CT or SPECT system, it could be vulnerable to attack by a relatively low-skill hacker, according to a July 26 security advisory from the company.

Continue reading >

Topics:

Electronic Health Records

Risk tolerance is an interesting thing. Those who make the biggest bets often are actually control freaks—maybe because they know that, by having a strong grasp on the factors that influence the deal, they greatly increase the likelihood that they will come out ahead.

Continue reading >

Topics:

Value-Based Care,

Cost Accounting,

MACRA Summary

By banding together into what CMS has termed “virtual groups,” solo practitioners and small medical groups can take advantage of significant flexibility currently available to help them succeed in the Merit-based Incentive Payment System (MIPS).

In Part 1 of this series, we answered some FAQs about these MIPS virtual groups. In Part 2, we share items to consider before joining a virtual group.

Continue reading >

Topics:

APMs,

MIPS Healthcare,

MACRA Summary

Small physician groups and solo practitioners take heart: CMS wants you to be successful in the Merit-based Incentive Payment System (MIPS) without having to merge or be acquired.

Continue reading >

Topics:

APMs,

MIPS Healthcare

A Bridge for Healthcare Reform

Over the past decade, clinical co-management arrangements (CCMAs) have risen in popularity as a means to achieve a more integrated care delivery model. CCMAs have often been touted as an interim strategy to bridge hospitals to newer emerging models, but many hospitals have yet to cross that bridge.

Continue reading >

Topics:

Healthcare Reform,

Payment Models,

APMs

As discussed in my previous blog post, the IRS is ramping up compliance audits of governmental hospitals who are exempt under 501(c)3. However, the IRS isn’t the only one monitoring your tax-exempt hospital. Other organizations have started policing these requirements.

Continue reading >

Topics:

Affordable Care Act Summary,

CHNA,

Hospital Management

The previous installment of this blog series described the CMS Innovation Center and its mission to test innovative payment and delivery models and to implement the MACRA Quality Payment Program (QPP).

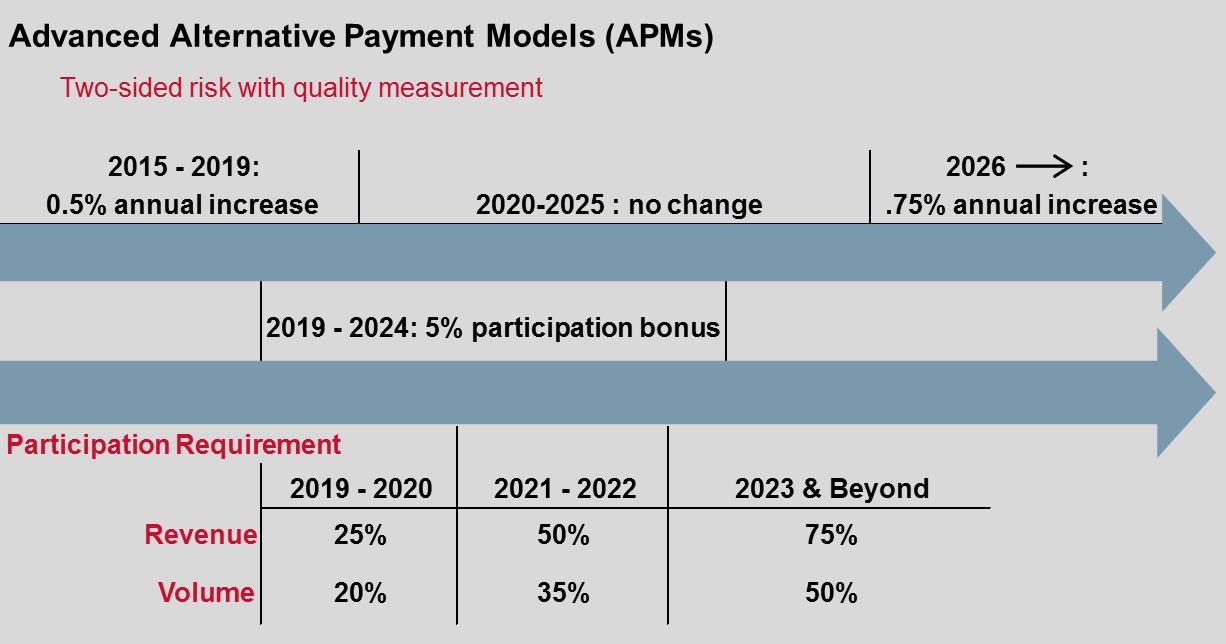

The QPP is designed to help achieve HHS’ goal of tying half of Medicare fee-for-service payments to quality or value through Advanced Payment Models (APMs) by 2018. Advanced APMs, one of the two tracks of MACRA, allows physician practices to earn more by assuming some financial risk related to patients’ outcomes. Certain Accountable Care Organizations (ACOs) in the Medicare Shared Savings Program (MSSP), including the new MSSP Track 1+ ACO, qualify as Advanced APMs.

Continue reading >

Topics:

Value-Based Care,

APMs,

Quality Payment Program,

MACRA Summary

The Affordable Care Act created the CMS Innovation Center to allow Medicare and Medicaid programs to test innovative payment and delivery models that improve patient care and lower healthcare costs.

Continue reading >

Topics:

Affordable Care Act Summary,

APMs

Is your governmental hospital exempt under Section 501(c)3? If you have a 403(b) plan, the answer is yes; and even if you don’t—you need to check.

Continue reading >

Topics:

CHNA,

Health Care Audit