If your company uses leases to acquire assets without huge cash outlays, to enjoy lower interest rates than is possible with loans, or to reduce the risks of ownership, you may need to re-examine your lease and purchase decisions very soon. On November 11, the Financial Accounting Standards Board voted to proceed with the issuance of a final Accounting Standards Update on leases in early 2016.

This update affects leases in one critical area: companies will no longer be able to keep obligations for lease payments off their balance sheets through the use of operating leases. The new standard will bring trillions of dollars of historically off-balance-sheet operating leases into the books.

Major Changes

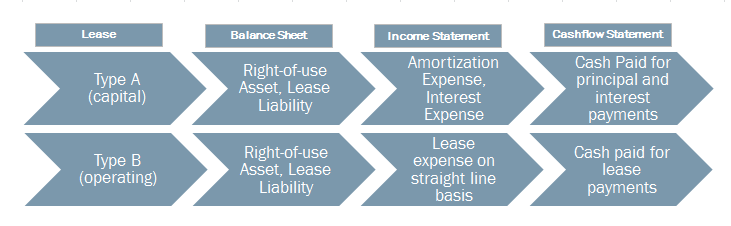

Most of today’s capital leases will be classified as Type A leases and will be accounted for in the same way. Most operating leases will be classified as Type B leases, but will no longer be off-balance sheet. Instead, they will be recognized as an asset and a liability on the balance sheet, based on the present value of future lease payments.

Balance sheet presentation will not be required for leases of one year or less. The diagram below illustrates how the lease model will impact the financial statements of companies with operating leases.

It is important to note that these changes will primarily affect lessees. The lessor accounting model is expected to remain much as it is today.

Assessing the Potential Impact

Businesses that lease assets today should begin to think about how they will implement the upcoming standard and mitigate its consequences. The standard will become effective for public companies in 2019 and private companies in 2020. Companies, however, will have to begin collecting data and updating systems much earlier than the effective dates in order to prepare comparative financial statements.

Here are a few areas that could impact your business and are important to consider in planning a smooth transition:

- Buy vs. Lease Decisions

As more leases will now be capitalized, companies will have to weigh the costs and benefits of decisions involving operating leases. Leasing strategy will need to be reevaluated for lease or buy decisions, as well as the lease terms for leases in a company’s portfolio.

- Compliance with Debt Agreements

The standard will impact your balance sheet, which will impact financial ratios. Assessing and quantifying the impact of capitalizing right-of-use assets and recognizing lease liabilities will be important as you make sure your company remains in compliance with its debt covenants and other potential agreements and regulations.

- Financial Reporting

Not only will the new model change the way that leases are recognized, it will increase the amount of disclosures required for you to remain in compliance with GAAP. Adapting current accounting policies and capturing information for new disclosures will become necessary.

- Systems and Internal Controls

It is likely your company will have to design and implement new systems, which will require advance planning. You will want to capture data concerning both existing and new leases. You should contact your accounting software or ERP vendor to ask how they will support the lease-accounting changes. As always with new systems and processes, internal controls must be adjusted to ensure proper financial reporting.

Although 2019 and 2020 seem to be in the distant future, these changes will require some significant accommodations. Early planning will ensure that your business can transition smoothly without headaches. Take a proactive approach to your company’s operations and financial reporting and begin preparing and collaborating now.

For weekly insights into enterprise complexity, please sign up here:

Leave A Comment