On December 22, 2017, President Trump signed sweeping tax reforms into law. As a result of the new and modified federal provisions, state conformity has become a popular topic of conversation among tax practitioners. Many states will have to make difficult decisions, and several have already started the process.

The federal tax reform package lowered individual and corporate tax rates, scaled back or eliminated many current deductions, credits, and incentives for businesses and individuals, and allowed for repatriation of foreign-held funds. Also of note, the reforms established a new deduction for pass-through income available to most non-corporate entities. While the reforms only address federal taxes, the implications are far reaching and will affect a large number of states. Most states incorporate provisions of the federal tax code into their own statutes and regulations, a practice known as “state conformity.” The degree to which a state relies on the federal law will determine the significance of the impact on its tax revenue.

Breaking Down State Conformity

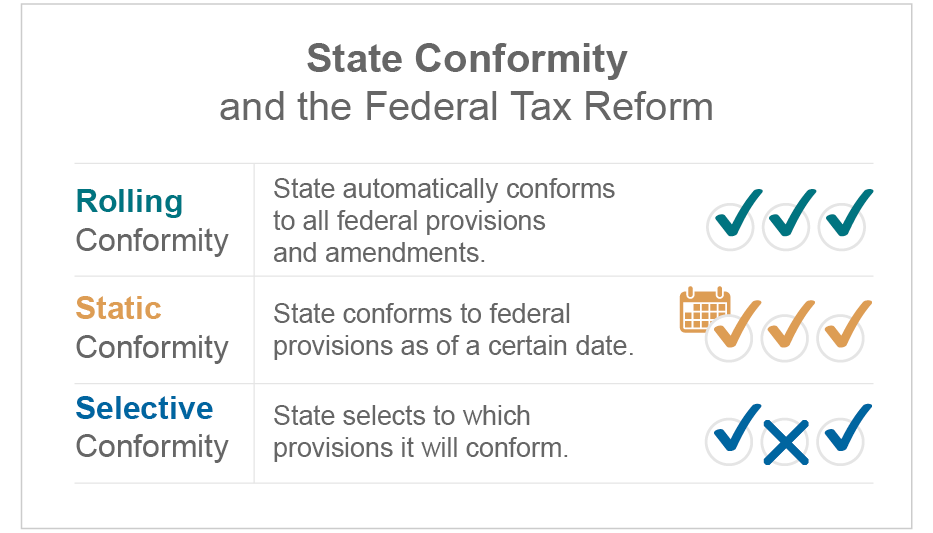

There are three types of state conformity; rolling conformity, static conformity, and selective conformity. Prior to the federal tax reforms, eighteen states and the District of Columbia were considered “rolling conformity” states. This means that they conform to federal provisions and automatically follow any federal revisions or amendments.

Nineteen states are “static,” or “fixed date” conformity states. These states follow the Internal Revenue Code (IRC) as of a certain date. For instance, a state’s law may require that the state will follow the Internal Revenue Code as of July 1, 2017. In this example, the state would not conform to the federal revisions because they were passed in December of 2017, after the conformity date.

The remaining states that do conform to the IRC are considered “selective conformity” states. These states decide on a case-by-case basis whether or not they will conform to various sections of the IRC. Mississippi, for example, is a selective conformity state. Mississippi follows some federal provisions, but does not allow additional bonus depreciation.

A number of states use federal taxable income or federal AGI as a starting

What does federal tax reform mean for state taxes?

Click the image for a full list of State responses

Because of the potential impact on revenues, states are mulling over their options. Some states may decide to decouple from certain provisions, such as the pass-through deduction provision, in order to increase revenues. Other states may choose to conform to certain income-decreasing provisions, such as the revised depreciation rules, to encourage growth.

State legislatures seem to be focusing a lot of their effort on the effects of the limitations placed on the state and local income tax deductions. Those states that assess a higher rate of tax argue that the reforms place an unnecessary burden on individuals residing in high-tax jurisdictions. It is apparent that some states are looking to potentially circumvent the effects of the limitations by allowing charitable contributions to the state in lieu of taxes paid. By allowing individuals to make a charitable donation to a state-created trust, and in turn, providing a tax credit for the same amount, states would be able to nullify the effects of the reform on residents.

Several states who have historically conformed to the IRC are now exploring decoupling from certain provisions. Many states are looking to implement their own personal exemptions or adjust their standard deductions to shelter residents from the effects of the reforms. Other states will be looking to adopt certain provisions of the reforms in order to boost revenues.

Stay Vigilant to Keep Track of State Tax Changes

We are beginning to see certain trends emerge at the state-level. While many states have taken action, many others have remained silent. Mississippi, for instance, has not released any public statements or passed any legislation in response to the federal tax reforms. Practitioners, as well as taxpayers, will be eagerly waiting to see what all of the states intend to do.

I also expect states to attempt to capitalize on the uncertainty and confusion created by the reforms. They will look to the recent federal tax reforms as an opportunity to generate revenue, not only through legislation, but also through aggressive audit programs. In order to insulate our clients from the pitfalls of uncertainty, practitioners will need to remain vigilant in their research.

One thing is certain. Changes are coming, both at the federal and the state level. As practitioners, it is our responsibility and our duty to our clients to stay on top of these changes. With change comes opportunity, and I expect practitioners who stay current on the changes, as well as their clients, will benefit greatly.

Stay up-to-date on changes in state taxes as a result of federal tax reform.

Leave A Comment