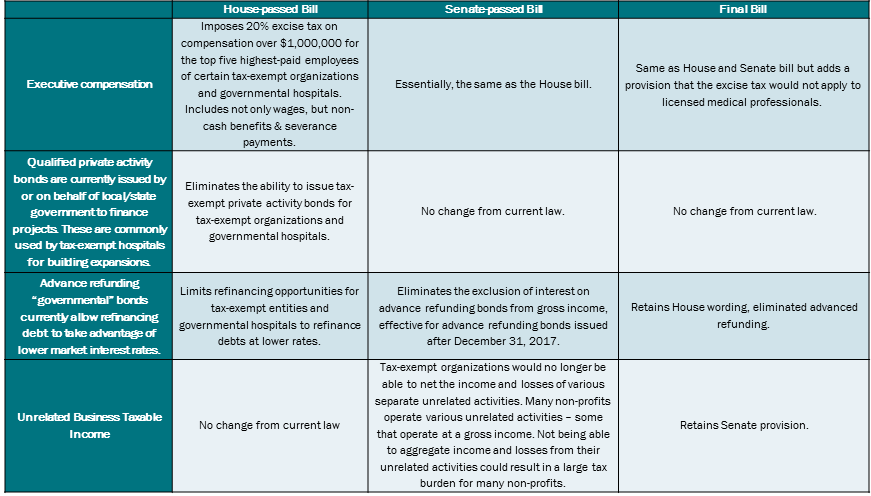

Last week, we provided a high-level overview of components that would directly affect healthcare. With the finalized tax bill passed today, we have updated those components to include results of the final bill.

During the consensus process to reconcile the Senate and House bills, beneficial changes were made to tax-exempt organizations, and specifically, hospitals.

A provision to the final bill was added eliminating the executive compensation excise tax to licensed medical personnel. This was a major concern for many hospitals, as their executives are often also highly paid medical professionals.

The final bill rejected the House’s position on removing private activity bonds which keeps these bonds the same under current law. This is a huge relief for hospitals and other tax-exempt organizations that depend on these bonds for financing of large capital projects. However, the final bill excluded the advanced refunding of governmental and 501(c)(3) bonds, essentially making refinancing of these bonds impossible going forward.

While the executive compensation and tax-exempt bond changes were favorable to hospitals, the unrelated business taxable income provisions were not. The final bill retained the Senate’s provisions for unrelated business taxable income.

Overall, the changes softened the blow a bit for hospitals; however, the inability to aggregate unrelated business activities will result in a significant tax burden for many nonprofits.

For weekly insights into healthcare, please sign up here:

Leave A Comment