Today, WRVUs are one of the most prevalent measures by which employers determine physician compensation. WRVUs have the benefit of rewarding physicians for personally performed services based on relative values utilized by CMS without penalizing the physician for charity care provided on behalf of the hospital or for revenue cycle issues outside of the physician’s control. However, misconceptions still exist surrounding the selection of appropriate conversion rates for physician arrangements. Here are three common pitfalls to avoid when establishing a compensation-per-WRVU contract.

Sole Reliance on Survey Data May Result in Undesirable Practice Losses

Employers must be cognizant of the DOJ’s recent scrutiny on practice losses when establishing physician compensation arrangements and should be aware of the effects of a guaranteed conversion factor on the practice’s financials. While practice losses do not automatically indicate that an arrangement falls outside of FMV and commercial reasonableness, the documented reasons for an appropriate loss should be a key consideration when establishing physician compensation.

For some employers, a median conversion factor is the default incentive rate used in physician contracts. However, employers should note the median is simply the midpoint within the data set and does not reflect specific facts and circumstances unique to each market or arrangement. By comparison, the subject arrangement may vary materially in its revenue cycle, leverage model, production volume, etc.

Survey data also represents prior-year compensation, which in many cases is determined by contracts signed in years previous to the data itself. As the market transforms from volume to value reimbursement, survey data will lag behind significant changes taking place in the revenue cycle, and failure to account for at-risk payments in a WRVU-based contract will likely have a negative impact on the practice’s financials. Therefore, sole reliance on published survey data may not necessarily result in FMV when proper consideration should also be given to practice income and/or alternatives to the arrangement.

(For further discussion of limitations to published survey data, click here.)

Higher Productivity Correlates with Lower Compensation-per-WRVU

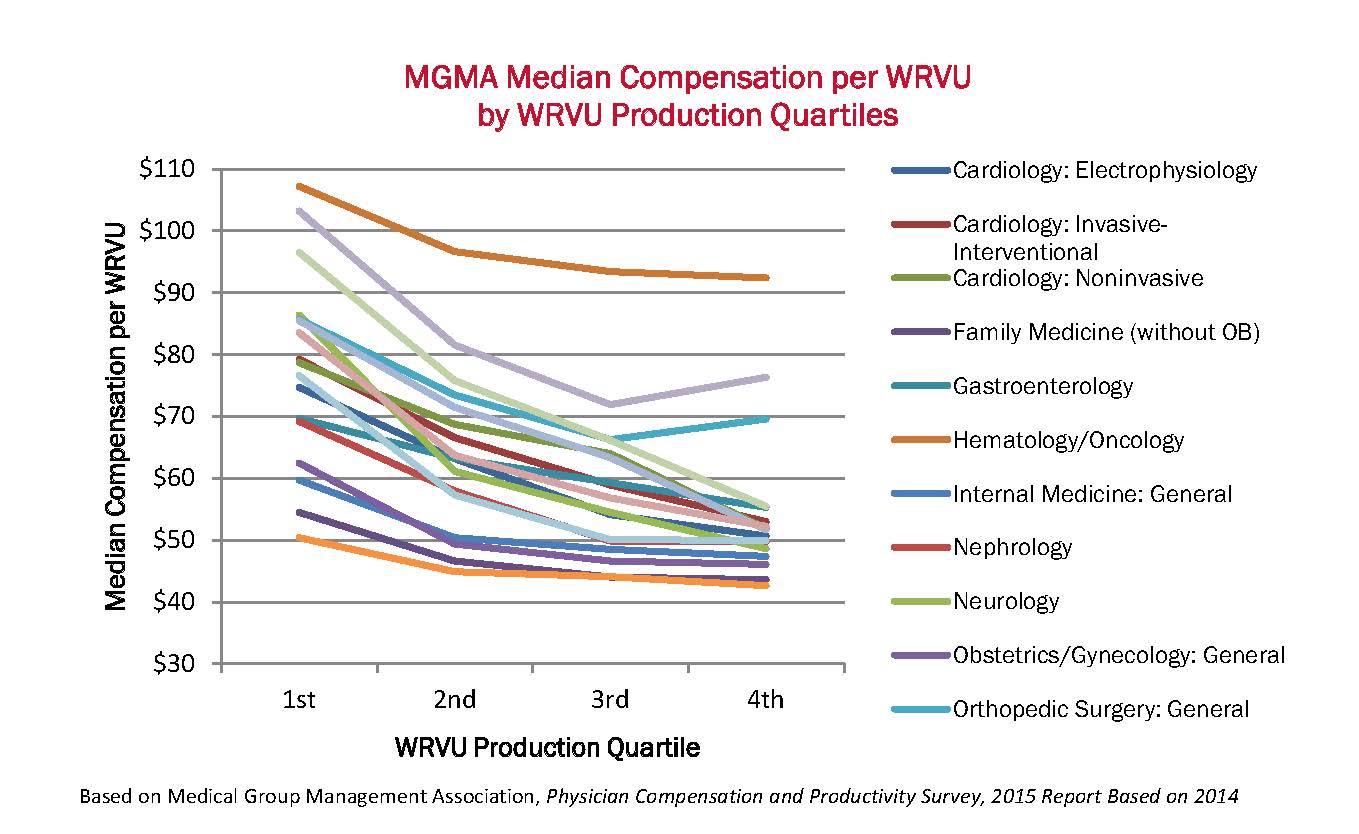

Contrary to the instinct of many employers, survey data actually indicates that most higher producing physicians receive compensation-per-WRVU below the median. As presented in the table below, MGMA shows a negative correlation between production and compensation-per-WRVU rates for key specialties.

Analysis of survey data for the specialties above indicates that the median of only the highest producing physicians (4th quartile WRVU producers) is on average 12 percent less than the overall median (all WRVU respondents) in the corresponding specialty. Explanations for this negative correlation may be linked to physician guarantees, semi-variable practice costs, and/or varying leverage models. Whatever the underlying factors, the trend is convincing that higher producers are most often paid below median compensation-per-WRVU.

WRVUs Should Be Adjusted for Modifier Usage

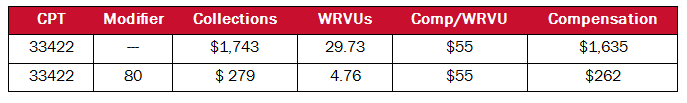

For employers who are new to WRVU-based contracts, it is not always apparent that physician WRVUs should be adjusted for corresponding modifiers. Several modifiers indicate that clinical services vary in scope from their corresponding base CPT code (Copyright 2014 American Medical Association. All rights reserved. CPT is a registered trademark of the American Medical Association) and subsequently result in lower reimbursement. Therefore, failure to adjust WRVUs for modifier usage creates a disconnect between physician compensation and corresponding revenues. In the extreme example below, failing to adjust for a surgical assist modifier results in overpayment of almost six times the Medicare allowable.

It is also important to note that most widely utilized published surveys report WRVUs adjusted for modifiers. Therefore, if employers use survey data to establish a conversion factor, the resulting total compensation will likely be overstated if the employer does not adjust WRVUs to match survey definitions. Because these adjustments can vary by carrier, the AMGA survey provides the following standard adjustments:

The current transformation should encourage employers to re-visit existing physician compensation models to address value-based compensation, monitor market developments, and modify new compensation plans as necessary to meet market changes. Fee-for-service is not dead, but employers should understand the impact that value-based reimbursement will have on their practices and develop a deeper understanding of the survey data when blending productivity-based incentives and quality-based pay in physician contracts.

Join the conversation and receive updates of new post:

Leave A Comment