Partly because of economic volatility, longer-term brokered CDs have become more competitive in the past few years. In recent regulatory proposals, the competitive environment could get significantly more challenging. Traditional banks should be aware of the regulatory conversations and prepared to take their customers through the process of considering and pursuing these investment vehicles.

Historically, brokered CDs have been investment vehicles issued by banks and sold through brokerage firms (e.g., Fidelity or Vanguard). For investors seeking higher interest yields, brokered CDs were a good option. Like direct bank CDs, they are covered by federal deposit insurance. And they typically yield between 0.3 and 0.5 percentage point more than straight bank deposits.

As with so many things in the world, the benefits of brokered deposits come with a trade-off – namely, the risk of loss. “Unlike direct CDs, brokered CDs have no early-withdrawal penalty, and in a pinch, you can sell them on the secondary market. But if rates have climbed, you'll likely receive less than what you paid for it.”[1] If the investor needs to collect their investment before the CD matures, he or she will have to sell it on the secondary market. If interest rates climb, the market value of the CD will fall.

Changes to the Financial Regulatory Framework for Brokered Deposits

In November 2017, Senate Banking Committee Chairman Mike Crapo cut a deal with moderate Democrats to amend the Dodd-Frank Act and provide regulatory relief to financial institutions. His intent with this series of bipartisan proposals is to, “significantly improve our financial regulatory framework and foster economic growth by right-sizing regulation, particularly for smaller financial institutions and community banks.”[2]

In November 2017, Senate Banking Committee Chairman Mike Crapo cut a deal with moderate Democrats to amend the Dodd-Frank Act and provide regulatory relief to financial institutions. His intent with this series of bipartisan proposals is to, “significantly improve our financial regulatory framework and foster economic growth by right-sizing regulation, particularly for smaller financial institutions and community banks.”[2]

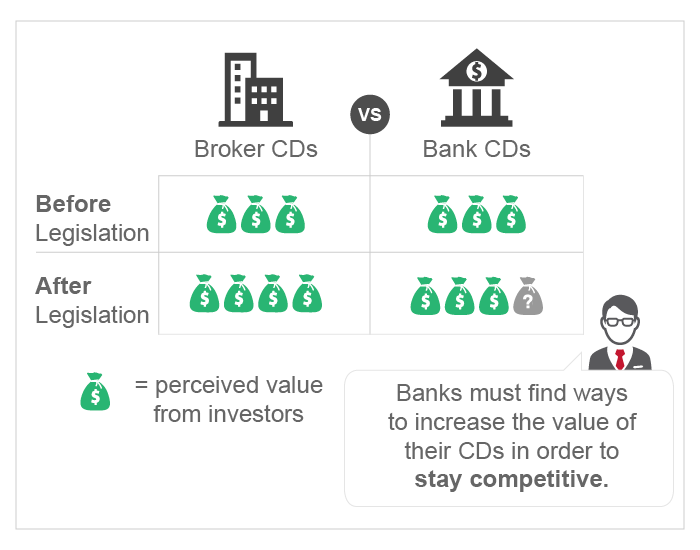

One of the details in the bill increases competition for those banks that offer brokered deposits. It changes how the FDIC treats reciprocal deposits. Specifically, brokered deposits that offer well-insured, over-the-counter CD packages with banks will now be viewed as public business entities. This legislative change creates a new source of legitimate competition for banks because it recognizes an entity that offers brokered CDs as a public business for tax purposes.

How Banks Should Respond to the Change in Reciprocal Deposits

If your bank is at risk of being impacted by the legislative change and increased competition, have faith. Look at your existing client relationships. Begin by explaining how and why brokered CDs are safe, stable vehicles for growing their money. Explain details like how the process will raise CD amounts and reduce their withdrawal fees. Clarify the pros and cons of brokered deposits in general.

Your more conservative customers, in particular, will need not only the information but also the assurance that you are – as always – watching out for their best interest. With the right knowledge and comfort, they will be more willing to take risks they may not have considered otherwise.

With the potential for recognition as a public business entity, the general public perception of brokered deposits could shift towards a more normalized acceptance regarding risk. It is important for traditional banks to communicate to clients that this public recognition (if enacted) does not mitigate the risk involved in the brokered deposits. Rather, banks offer a safer and more stable form of depository growth solution for those that do not desire to ride the twists and turns in the market.

Subscribe to the blog so you can stay informed and join the conversation:

[1] http://www.nasdaq.com/article/boost-your-returns-with-brokered-cds-cm796635

[2] https://www.americanbanker.com/news/cheat-sheet-inside-crapos-reg-relief-deal-with-democrats

Leave A Comment